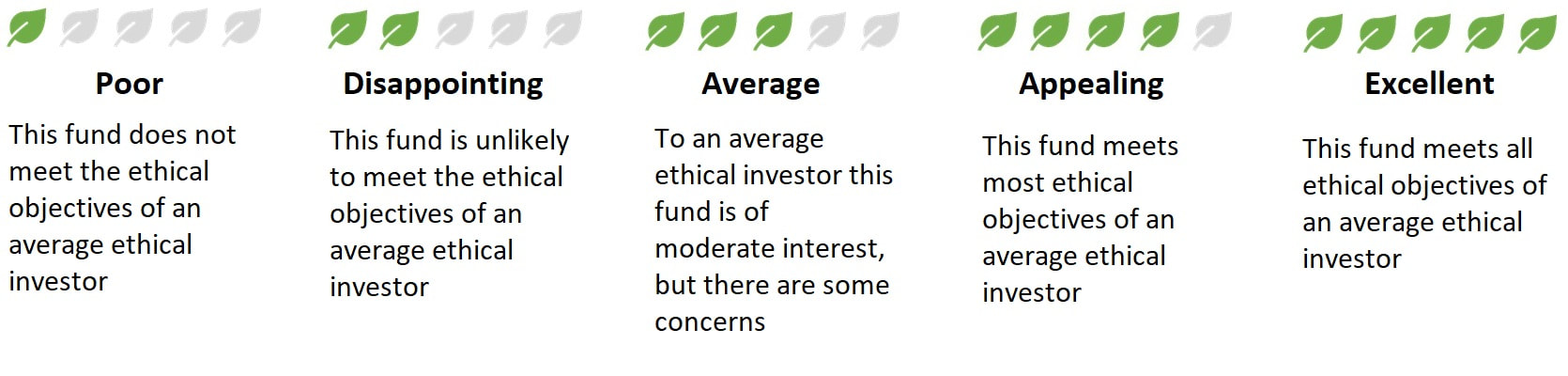

How the Leaf-System Works

The ethical rating is voted by Australian financial advisers who specialise in ethical investment advice and who are members of the Ethical Advisers Co-operative. The co-op members assess if the fund's ethics suit their average ethical client, and if it matches with the average client’s expectations and ethical objectives.

The fund's have been reviewed and rated by the co-op members based on their ethics only. This includes their environmental, social and corporate governance credentials. This includes the fund's underlying investments, their research and screening methods and the funds voting on important Environmental, Social & Governance issues related to the underlying investments.

Co-op members consider how the fund performs based on how they;

1) removing industries and stocks harmful to the environment and society

2) including companies with environmental or social benefits, and

3) providing evidence of the funds positive social and environmental impacts.

The quality of information the fund provides on its ethical policies, companies invested in and proxy voting is important in assessing if a fund is as ethical as claimed. The final rating is an average of these votes. You can see on the ‘Find an Adviser’ page some of the advisers who have contributed to the voting.

Co-op members are voluntarily participating in these ratings to help ethical consumers gain a quick understanding of how the clients of a group of industry professionals view the ethics of each fund. The co-op and the co-op members do not receive any form of remuneration or reward for participating in the survey, nor do any of the super funds or other investments.

The co-operative have rated funds which have an ethical or sustainability focus. We applaud all investment managers who attempt to invest ethically and sustainably. There are quite significant efforts being taken within the finance industry to develop more ethical and sustainable investments.

All of the funds rated by the co-operative are making an effort to invest in more environmentally sustainable, ethical and socially responsible investments. The Ethical Fund Ratings website is designed to help you understand the differences between these funds, to help make a choice about investing in an ethical fund, and to help ensure that the fund you invest in meets your personal ethical values. The co-op would like to note while those funds with a score of less than 3 'leaves' are unlikely to meet the requirements of an average ethical investor, this is a far better rating than the majority of investment and superannuation funds which aren't taking into account investors' ethics, and which would receive a score of zero leaves.

The ratings do not include financial information about the funds, including investment performance or fees. The funds have been reviewed and rated by advisers that are part of the co-op based on each funds' ethics only. This includes things like the fund's environmental and social credentials including the underlying investments, their research and screening methods and their voting records and engagement on important issues.

Ethical Considerations

The considerations used by co-op members when voting include:

Transparency of underlying holdings. Reviewing an entire portfolio of holdings sheds light onto the entire portfolio rather than just the top ten investments. There may be investments held that are not in line with a consumer’s values which they are not even aware of if the entire portfolio is not disclosed. Does the fund disclosure their entire portfolio or only their top ten holdings?

Fund Manager Engagement. Fund managers like other investors have the chance to vote for resolutions in the companies in which they invest. As they often have large holdings of stocks their votes can have a big impact. They can also engage with companies directly by meeting with their boards and raising ESG concerns, again as they often have large holdings the boards often hear them out. Does the fund manager engage either directly or by voting with underlying investments on ethical issues such as human rights? Does the manager disclose their voting record?

ESG Research. Environmental, Social and Governance (ESG) research can be obtained from a number of research houses and also done by fund managers team. Does the fund manager use ESG Research in their investment decision making?

ESG Screening. Environmental, Social & Governance (ESG) Screening can be used to screen out negative investments such as fossil fuels and seek out positive investments such as renewable energy. Does the fund manager use Positive and/or Negative screening in their investment decision making? Does the negative screening use materiality and thresholds which make it useless? Does the positive screening measure impact and is their genuine measurable impact?

Investment Theme or methodology. Many funds have a theme such as Technology Theme where the fund may invest the majority all of its assets into different types of technology. Is the overall investment Theme (if any) attractive?

Other Considerations:

The following is a basic outline of positive and negative ethical screens that our clients would want in an ethical super or investment fund.

Negative Screen (fund should avoid everything in this list, ideally with a 0% threshold)

Positive Screen (fund should target these areas)

In addition, the following aspects of each company should be taken into account:

The ethical rating is voted by Australian financial advisers who specialise in ethical investment advice and who are members of the Ethical Advisers Co-operative. The co-op members assess if the fund's ethics suit their average ethical client, and if it matches with the average client’s expectations and ethical objectives.

The fund's have been reviewed and rated by the co-op members based on their ethics only. This includes their environmental, social and corporate governance credentials. This includes the fund's underlying investments, their research and screening methods and the funds voting on important Environmental, Social & Governance issues related to the underlying investments.

Co-op members consider how the fund performs based on how they;

1) removing industries and stocks harmful to the environment and society

2) including companies with environmental or social benefits, and

3) providing evidence of the funds positive social and environmental impacts.

The quality of information the fund provides on its ethical policies, companies invested in and proxy voting is important in assessing if a fund is as ethical as claimed. The final rating is an average of these votes. You can see on the ‘Find an Adviser’ page some of the advisers who have contributed to the voting.

Co-op members are voluntarily participating in these ratings to help ethical consumers gain a quick understanding of how the clients of a group of industry professionals view the ethics of each fund. The co-op and the co-op members do not receive any form of remuneration or reward for participating in the survey, nor do any of the super funds or other investments.

The co-operative have rated funds which have an ethical or sustainability focus. We applaud all investment managers who attempt to invest ethically and sustainably. There are quite significant efforts being taken within the finance industry to develop more ethical and sustainable investments.

All of the funds rated by the co-operative are making an effort to invest in more environmentally sustainable, ethical and socially responsible investments. The Ethical Fund Ratings website is designed to help you understand the differences between these funds, to help make a choice about investing in an ethical fund, and to help ensure that the fund you invest in meets your personal ethical values. The co-op would like to note while those funds with a score of less than 3 'leaves' are unlikely to meet the requirements of an average ethical investor, this is a far better rating than the majority of investment and superannuation funds which aren't taking into account investors' ethics, and which would receive a score of zero leaves.

The ratings do not include financial information about the funds, including investment performance or fees. The funds have been reviewed and rated by advisers that are part of the co-op based on each funds' ethics only. This includes things like the fund's environmental and social credentials including the underlying investments, their research and screening methods and their voting records and engagement on important issues.

Ethical Considerations

The considerations used by co-op members when voting include:

Transparency of underlying holdings. Reviewing an entire portfolio of holdings sheds light onto the entire portfolio rather than just the top ten investments. There may be investments held that are not in line with a consumer’s values which they are not even aware of if the entire portfolio is not disclosed. Does the fund disclosure their entire portfolio or only their top ten holdings?

Fund Manager Engagement. Fund managers like other investors have the chance to vote for resolutions in the companies in which they invest. As they often have large holdings of stocks their votes can have a big impact. They can also engage with companies directly by meeting with their boards and raising ESG concerns, again as they often have large holdings the boards often hear them out. Does the fund manager engage either directly or by voting with underlying investments on ethical issues such as human rights? Does the manager disclose their voting record?

ESG Research. Environmental, Social and Governance (ESG) research can be obtained from a number of research houses and also done by fund managers team. Does the fund manager use ESG Research in their investment decision making?

ESG Screening. Environmental, Social & Governance (ESG) Screening can be used to screen out negative investments such as fossil fuels and seek out positive investments such as renewable energy. Does the fund manager use Positive and/or Negative screening in their investment decision making? Does the negative screening use materiality and thresholds which make it useless? Does the positive screening measure impact and is their genuine measurable impact?

Investment Theme or methodology. Many funds have a theme such as Technology Theme where the fund may invest the majority all of its assets into different types of technology. Is the overall investment Theme (if any) attractive?

Other Considerations:

- Is there a negative screen?

- Are there materiality thresholds in the negative screen? Are these thresholds too high?

- Is there a Positive screen?

- If impact is claimed, what is the level of genuine impact?

- The manager’s commitment to the ethical finance industry.

The following is a basic outline of positive and negative ethical screens that our clients would want in an ethical super or investment fund.

Negative Screen (fund should avoid everything in this list, ideally with a 0% threshold)

- Animal cruelty

- Carbon intensive industries

- Child Labour

- Excessive consumerism

- Fossil Fuels (including transportation, refinement and the financing of fossil fuel projects)

- Gambling

- Genetic modification

- Land degradation caused by mining

- Old growth and native forest logging

- Third world exploitation

- Tobacco

- Uranium

- Weapons and armaments

Mining

Positive Screen (fund should target these areas)

- Clean technology

- Community development

- Community finance

- Energy Storage

- Fair trade

- Healthcare

- Organic produce

- Plantation forestry

- Recycling

- Renewable energy

- Sustainable design

- Waste management

- Water management

In addition, the following aspects of each company should be taken into account:

- Attitudes to indigenous rights

- Community relations

- Corporate Governance

- Employee Relations

- Equal opportunity

- Human rights abuse

- Integrity of products and services

- Labour practices